An experienced media buyer may spend tens of thousands of dollars each month on advertising. Yet surprisingly few stop to consider how the choice of payment card can influence campaign performance just as much as creative strategy or targeting.

Fees, spending limits, declined payments, and manual transaction moderation — these issues don’t just cause operational friction. They result in direct losses: time, money, and missed traffic.

In this article, we’ll examine which virtual cards offer the greatest advantages when paying for advertising traffic. Read on to discover why traditional bank cards are often suboptimal and which three virtual card services are best suited to advertising payments.

Table of Contents

Why Traditional Bank Cards Fall Short

Most advertisers rely on personal or corporate bank cards. These cards are designed for standard transactions — personal expenses or regular business payments not for the frequent and high-volume charges seen in advertising platforms.

Platforms like Google, Facebook, and TikTok don’t just check your balance and billing details. They analyse the behavioural fingerprint of your card. If the BIN doesn’t match the region, the bank has a high decline rate, or the card lacks support for advertising MCC codes, the risks increase:

- Payment declines

- Automatic bans

- Account freezes

- Limited budget control

Virtual cards address these challenges but only if they’re designed specifically for media buying rather than general e-commerce use.

What makes a good advertising card?

To support campaign launch and scaling rather than hinder it, a media buying card must meet five core criteria:

- A suitable BIN

The BIN (Bank Identification Number) — the first 6–8 digits of a card — determines the issuing country, bank, and even the perceived legitimacy of the transaction. Some virtual card services offer BINs that are more likely to pass moderation with Facebook and Google. This allows campaigns to run without constant manual reviews.

- Budgeting and limit controls

You should be able to adjust limits, open or close cards, and assign budgets per campaign or buyer swiftly. Linking each card to a specific offer or project reduces the risk of human error.

- Fast top-ups

Scaling up requires real-time budget flexibility. You can’t wait hours for a wire transfer to clear. A strong virtual card service enables top-ups within seconds via crypto wallets or payment gateways.

- Transparent fees

There should be no hidden charges for currency conversion, ghost authorisations, or unexpected holds. All fees should be visible before the transaction is made.

- Real-time support

When a payment fails, there’s no time to wait 48 hours for a reply. You need live chat support with someone who understands the issue and can resolve it on the spot.

Top 3 virtual card services for media buying

1. Spend.net

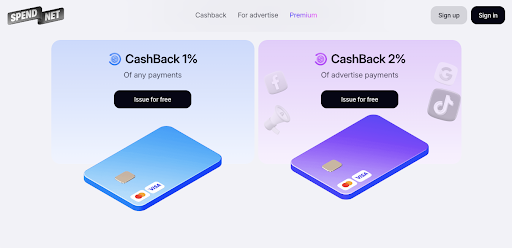

Spend.net offers virtual cards specifically designed for media buying. The platform provides two types of cards: ad-focused cards and general-purpose USD cards. All Spend.net cards are free to issue and operate globally, backed by Visa and Mastercard.

What sets Spend apart is its 2% cashback on advertising spend, automatically credited post-transaction and visible in the dashboard.

Buyers retain full control: there’s no limit on the number of cards, each can be tied to a specific campaign, and real-time analytics are available. Top-ups are accepted in USDT or BTC, with input fees set manually (starting from around 2%). All other operations — transactions, declines, refunds, conversions, and withdrawals are fee-free.

Technical specs:

- BINs: 20 BINs including 6 exclusive ones to enhance platform compatibility

- Registration: via Google account or email

- Financial control: team roles, task management, and exportable reports (CSV/XLS)

- Security: 3D Secure

- Support: 24/7 live chat with an account manager

2. Combo cards

Combo Cards delivers virtual cards with a focus on scalability and automation. Powered by Visa and Mastercard, they are accepted across major global ad platforms. AI tools assist users with real-time queries about card features, limits, and fees.

New users benefit from a soft entry: the first 20 cards are free, with subsequent cards costing $1–3 plus a small monthly fee.

Combo also supports affiliate payout reception, card rentals, and dev-ready accounts for Apple Store and Google Play, as well as international wire transfers — making it a versatile solution beyond just ad payments.

Top-ups can be made via crypto (USDT TRC20, BTC) or via an AdCombo balance. Input fees range from 3–5%. Regular transactions and declines are fee-free; other operations incur minimal charges.

Technical specs:

- BINs: Start with 5, scalable up to 30 for high-volume spenders; includes BINs from the US, UK, Estonia, Switzerland, and Colombia

- Security: 3D Secure

- Financial control: team roles and permissions, live transaction summaries in the dashboard

- Registration: via form and verification, cards issued within 72 hours

- Support: 24/7 AI chatbot

3. Yeezypay

Yeezypay issues virtual cards compatible with Visa, Mastercard, and UnionPay, purpose-built for ad accounts. Supported platforms include Facebook, Google, and Microsoft Ads — the full list is provided upon registration.

There are no limits on the number of cards and no fees on transactions or withdrawals. Top-ups are via USDT TRC20, with deposit fees starting at 3%. However, the minimum required top-up per card, including issuance fees, is 107 USDT — all of which goes onto the card balance for ad spend.

Note that Yeezypay cards do have usage limits and technical constraints, so advance planning is advisable.

Technical specs:

- BINs: 6 BINs from US-based banks

- Security: Encryption-based systems, Telegram alerts

- Financial control: expense reports available via a Telegram manager

- Registration: via Telegram bot

- Support: 24/7 support via Telegram

Conclusion

A media buyer using the right virtual card gains control. Budgets move without friction, campaigns launch on time, and performance analytics become clearer. Scaling is smoother, and spend can be tracked per offer or buyer.

Teams benefit even more: cards can be assigned to specific buyers, monitored, and deactivated when needed. This reduces the risk of internal errors or budget leaks.

Understanding the mechanics of virtual card systems is a key lever for growth. Spending an hour to evaluate the right provider can save thousands in ad spend and many more hours in troubleshooting.