As the number of organizations wanting to achieve the net-zero target is increasing, people have started to find ways to manage renewable energy efficiently. Virtual Power Purchase Agreements, or Virtual PPAs, have proven to be cost-effective for distributing renewable energy.Â

In this blog, we will discuss the significance of virtual PPAs. But before we do that, let us quickly understand how virtual PPAs help manage renewable energy.Â

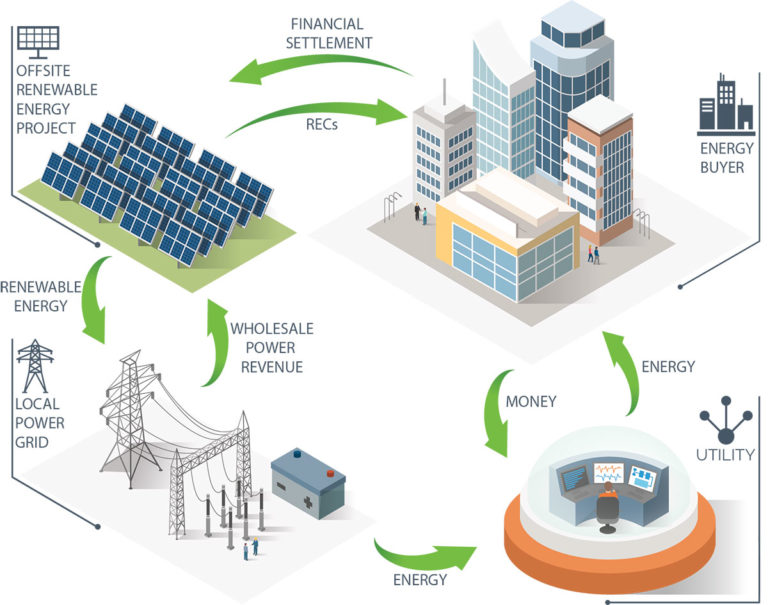

How Virtual PPAs Work?

Virtual PPAs are a type of renewable energy contracting structure that offers buyers security against future energy price fluctuations. The structure of a virtual PPA is set in a way that brings new green energy onto the grid. It does so on behalf of the renewable energy buyer.

Generally, buyers or off-takers are big organizations that consume electricity in large amounts. However, small to medium organizations can also use virtual PPAs to hedge against price fluctuations.Â

What is the Importance of Virtual PPAs?Â

Before virtual PPAs, physical PPAs were the norm up until a few years ago. But now, most organizations choose virtual PPAs over physical PPAs. The significance of virtual PPAs can be understood with their benefits mentioned below:

- Additionality

A virtual PPA locks the project at a pre-decided fixed price for the energy output. Doing this is essential for developers planning to finance new energy projects.Â

The bundle of renewable energy certificates is counted as adding new renewable energy to the grid. The new energy product would only take place with virtual PPAs. Hence, virtual PPAs are ‘additional’ in the literal sense of the word.

- Impact

Organizations that use virtual VPPAs are generally more conscious about their carbon footprint. When these organizations purchase unbundled RECs, they typically produce low impact as they may buy it even from existing resources. But virtual PPAs create more effective as they ensure a long-term contractual commitment to buy from a new energy project.

- Ability to Offset Dispersed Load

With a virtual PPA, companies can club their load to a single PPA without dealing with different market prices of different places where their facilities are located. This way, the most prominent organizations are offsetting their dispersed load in a very efficient manner.Â

- Positive Net Present Value

Virtual PPAs swap offers RECs at a fair price that can be counted by subtracting the wholesale market price from the virtual PPA price. If the difference between these two prices is positive, the buyer can generate a positive cash flow for themselves.Â

Although it was not possible earlier when the prices of virtual PPAs were generally more than or equal to the wholesale market price, generating cash flow has become possible as the costs of virtual PPAs are getting lower than market prices.

- Hedge

As mentioned earlier, a buyer can lock in the price for bundled RECs when they sign the virtual PPA. So, if the wholesale prices increase, the off taker can make more profit on the virtual PPA deal even when they are paying high wholesale prices.Â

Conversely, if the whole market prices drop, the off-taker will pay the net difference to the project but will also pay less for energy costs. This way, virtual PPAs act as a hedge against cost fluctuations.Â

To Sum Up

The undertaking of virtual PPAs is a little complicated for organizations that do not have expertise in the renewable energy domain. In such a situation, collaborating with a reputed electrical brand can prove to be fruitful. A brand with domain knowledge can reduce your exposure to unnecessary pricing risks.